Who needs Test Prep certifications AUDITING-AND-ATTESTATION, BUSINESS-ENVIRONMENT-AND-CONCEPTS, CGFM, CPA-REGULATION, FINANCIAL-ACCOUNTING-AND-REPORTING exam free dumps? Exametc has sorted out the complete Test Prep certifications exam dumps: AUDITING-AND-ATTESTATION dumps, BUSINESS-ENVIRONMENT-AND-CONCEPTS dumps, CGFM dumps, CPA-REGULATION dumps, FINANCIAL-ACCOUNTING-AND-REPORTING dumps! You can practice the test online! https://www.pass4itsure.com/test-prep.html Provide the latest Test Prep exam questions and answers.

Test Prep certifications exam dumps

[100% Free] AUDITING-AND-ATTESTATION pdf dumps 2020 https://drive.google.com/file/d/1trF3Ntq0PqUDTqA4Wk1C3aQMbEFaYR7o/view?usp=sharing

[100% Free] BUSINESS-ENVIRONMENT-AND-CONCEPTS pdf dumps 2020 https://drive.google.com/file/d/1KWKnJ56iO7Synidj1enGjLTNp158RwJQ/view?usp=sharing

Pass4itsure BUSINESS-ENVIRONMENT-AND-CONCEPTS dumps https://www.pass4itsure.com/business-environment-and-concepts.html

[100% Free] CGFM pdf dumps 2020 https://drive.google.com/file/d/1aX1sv-21svdK__Msjf4a94_wdt4-Rdhg/view?usp=sharing

Pass4itsure CGFM dumps https://www.pass4itsure.com/cgfm.html

[100% Free] CPA-REGULATION pdf dumps 2020 https://drive.google.com/file/d/1p9-j2gMeSmeZgfdbUFViaycGsrSZGotm/view?usp=sharing

Pass4itsure CPA-REGULATION dumps https://www.pass4itsure.com/cpa-regulation.html

[100% Free] FINANCIAL-ACCOUNTING-AND-REPORTING pdf dumps 2020 https://drive.google.com/file/d/1yTU88yV3ua2vLW4FYapzfiDwbE4Z_cVP/view?usp=sharing

Pass4itsure FINANCIAL-ACCOUNTING-AND-REPORTING dumps https://www.pass4itsure.com/financial-accounting-and-reporting.html

Test Prep Exam Practice Questions Free

Pass4itsure provide the latest Test Prep exam questions and answers.

Test Prep Certifications AUDITING-AND-ATTESTATION Practice Questions 1-5

QUESTION 1

This question will represent a statement, question, excerpt, or comment taken from various parts of an auditor\\’s

documentation file. Letter choices A-P represent a list of the likely sources of the statement, question, excerpt, or

comment.

Select, as the best answer for each item, the most likely source. Select only one source for each item.

The company believes that all material expenditures that have been deferred to future periods will be recoverable.

A. Practitioner\\’s report on management\\’s assertion about an entity\\’s compliance with specified requirements.

B. Auditor\\’s communications on significant deficiencies in internal control.

C. Audit inquiry letter to legal counsel.

D. Lawyer\\’s response to audit inquiry letter.

E. Communication from those charged with governance to the auditor.

F. Auditor\\’s communication to those charged with governance (other than with respect to significant deficiencies in

internal control).

G. Report on the application of accounting principles.

H. Auditor\\’s engagement letter.

I. Letter for underwriters.

J. Accounts receivable confirmation request.

K. Request for bank cutoff statement.

L. Explanatory paragraph of an auditor\\’s report on financial statements.

M. Partner\\’s engagement review notes.

N. Management representation letter.

O. Successor auditor\\’s communication with predecessor auditor.

P. Predecessor auditor\\’s communication with successor auditor.

Correct Answer: N

Choice “N” is correct. Management\\’s discussion of its belief that all material expenditures that have been deferred to

future periods will be recoverable provides information regarding recognition, measurement, and disclosure, and would

be included in the management representation letter.

QUESTION 2

An audit supervisor reviewed the work performed by the staff to determine if the audit was adequately performed. The

supervisor accomplished this by primarily reviewing which of the following?

A. Checklists.

B. Working papers.

C. Analytical procedures.

D. Financial statements.

Correct Answer: B

Choice “b” is correct. Audit documentation, or working papers, comprises the principal record of audit procedures

performed, evidence obtained, and conclusions reached. Reviewing the working papers allows a supervisor to

understand the

work performed and the evidence obtained, and to evaluate whether the audit was adequately performed.

Choice “a” is incorrect. Checklists might be used within the audit documentation, but checklists alone would not provide

a comprehensive record of the audit procedures performed, the evidence obtained, and conclusions reached. Choice

“c”

is incorrect. Analytical procedures might be documented within the working papers, but such procedures alone would

not provide a comprehensive record of the audit procedures performed, the evidence obtained, and conclusions

reached.

Choice “d” is incorrect. Reviewing the financial statements would provide no information regarding the audit procedures

performed, the evidence obtained, or conclusions reached, and therefore would provide no basis on which to review the

work performed by the staff.

QUESTION 3

An auditor most likely would limit substantive audit tests of sales transactions when control risk is assessed as low for

the occurrence assertion concerning sales transactions and the auditor has already gathered evidence supporting:

A. Opening and closing inventory balances.

B. Cash receipts and accounts receivable.

C. Shipping and receiving activities.

D. Cutoffs of sales and purchases.

Correct Answer: B

Choice “b” is correct. Examination of accounts receivable and cash receipts provides the auditor with evidence with

respect to both the completeness and the occurrence of sales transactions, thus limiting the need to test sales

transactions. Choice “a” is incorrect. Examination of beginning and ending inventory balances may provide limited

evidence of the occurrence of purchases and the cost of goods sold, but not of sales. Choice “c” is incorrect.

Examination of shipping and receiving activities would not necessarily reduce the testing of sales transactions. Choice

“d” is incorrect. Cutoffs of sales and purchases provides evidence regarding the sales occurring close to year-end, not

necessarily all sales for the year.

QUESTION 4

Proper authorization of write-offs of uncollectible accounts should be approved in which of the following departments?

A. Accounts receivable.

B. Credit.

C. Accounts payable.

D. Treasurer.

Correct Answer: D

Choice “d” is correct. The treasurer does not perform duties that are incompatible with authorizing writeoffs since he or

she is usually not involved with sales transactions or recordkeeping. Choice “a” is incorrect. Recording accounts

receivable and authorizing write-offs would constitute an improper segregation of duties. Choice “b” is incorrect.

Granting credit and authorizing write-offs represents an improper segregation of duties since non-existent customers

could have

credit authorized and then have their accounts written off.

Choice “c” is incorrect. The accounts payable department is typically involved in the expenditure cycle, not the revenue

cycle.

QUESTION 5

A limitation on the scope of an auditor\\’s examination sufficient to preclude an unqualified opinion will always result

when management:

A. Engages the auditor after the year-end physical inventory count is completed.

B. Fails to correct a material internal control weakness that had been identified during the prior year\\’s audit.

C. Refuses to furnish a management representation letter to the auditor.

D. Prevents the auditor from reviewing the audit documentation of the predecessor auditor.

Correct Answer: C

Choice “c” is correct. Management\\’s refusal to furnish a written representation letter constitutes a limitation on the

scope sufficient to preclude an unqualified opinion. Choice “a” is incorrect. Engaging the auditor after the year-end

physical

count is completed need not preclude an unqualified opinion if the auditor can apply satisfactory alternative audit

procedures. Choice “b” is incorrect. Failure to correct a material internal accounting control weakness that had been

identified

during the prior year\\’s audit need not preclude an unqualified opinion, although it may require the auditor to apply

extended auditing procedures.

Choice “d” is incorrect. Inability to review the predecessor\\’s prior year audit documentation may cause the successor

auditor more work but need not preclude an unqualified opinion in the current year.

Test Prep Certifications BUSINESS-ENVIRONMENT-AND-CONCEPTS Practice Questions 1-5

QUESTION 1

Which one of the following statements concerning pure monopolies is correct?

A. The demand curve of a monopolist is perfectly elastic.

B. The price at which a monopolist maximizes its profit is where price equals both marginal cost and marginal revenue.

C. A monopolist\\’s marginal revenue curve lies below its demand curve.

D. The supply curve of a monopolist is perfectly inelastic.

Correct Answer: C

Choice “c” is correct. A monopolist\\’s marginal revenue curve lies below its demand curve.

Choice “a” is incorrect. The demand curve of a monopolist is not perfectly elastic.

Choice “b” is incorrect. A monopolist sets its price higher than marginal revenue.

Choice “d” is incorrect. A monopolist can change the quantity supplied or fix the price but cannot do both

simultaneously. In any case, its supply curve is not perfectly inelastic.

QUESTION 2

The term underwriting spread refers to the:

A. Commission percentage an investment banker receives for underwriting a security lease.

B. Discount investment bankers receive on securities they purchase from the issuing company.

C. Difference between the price the investment banker pays for a new security issue and the price at which the

securities are resold.

D. Commission a broker receives for either buying or selling a security on behalf of an investor.

Correct Answer: C

Choice “c” is correct. Investment bankers are paid their fees partly by being allowed to purchase the new securities they

are underwriting for a discount and then reselling those securities on the market. This is known as the underwriting

spread.

Choices “a” and “d” are incorrect, as both of these describe either fees or commissions and not an underwriting spread.

Choice “b” is incorrect. The underwriting spread is the difference between the discount price paid and the resale price.

QUESTION 3

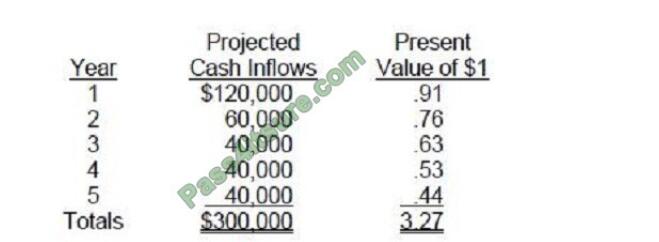

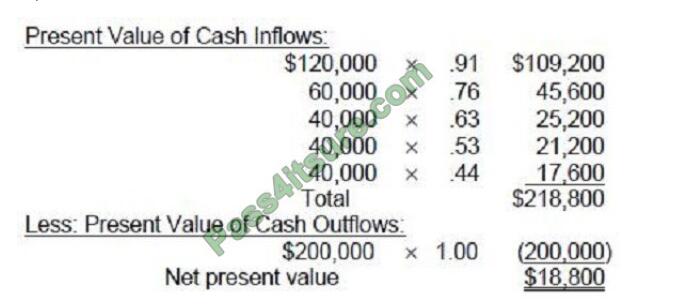

The Keego Company is planning a $200,000 equipment investment, which has an estimated five-year life with no

estimated salvage value. The company has projected the following annual cash flows for the investment.

The net present value for the investment is: A. $18,800

B. $196,200

C. $(3,800)

D. $91,743

Correct Answer: A

Choice “a” is correct. $18,800 net present value. The net present value of an investment is calculated as the present

value of the cash inflows minus the present value of the cash outflows. In this case, there is only one cash outflow (at

the purchase date), and that amount ($200,000) is already at present value (or, is multiplied by a present value factor of

1.0).

QUESTION 4

The annual tax depreciation expense on an asset reduces income taxes by an amount equal to:

A. The firm\\’s average tax rate times the depreciation amount.

B. One minus the firm\\’s average tax rate times the depreciation amount.

C. The firm\\’s marginal tax rate times the depreciation amount.

D. One minus the firm\\’s marginal tax rate times the depreciation amount.

Correct Answer: C

Choice “c” is correct. The annual tax depreciation expense reduces income taxes by an amount equal to the firm\\’s

marginal tax rate (the tax on the next dollar of income) times the depreciation amount. Choices “a”, “b”, and “d” are

incorrect, per above.

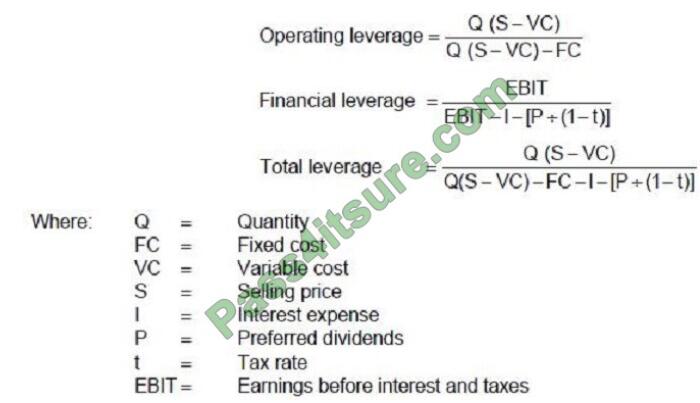

QUESTION 5

Carlisle Company presently sells 400,000 bottles of perfume each year. Each bottle costs $.84 to produce and sells for

$1.00. Fixed costs are $28,000 per year. The firm has annual interest expense of $6,000, preferred stock dividends of

$2,000 per year, and a 40 percent tax rate. Carlisle uses the following formulas to determine the company\\’s leverage.

The degree of financial leverage for Carlisle Company is:

A. 2.4

B. 1.78

C. 1.35

D. 2.3

Correct Answer: C

Test Prep Certifications CGFM Practice Questions 1-5

QUESTION 1

The auditors provide _______________ of the reliability of the financial statements.

A. Reasonable assurance

B. Sample

C. Material misstatement

D. None of these

Correct Answer: A

QUESTION 2

Commercial papers are sold through:

A. Secondary market

B. Dealers

C. Directly by issuers and has no secondary market

D. Both BandC

Correct Answer: D

QUESTION 3

Line-Item Budget is more appropriate for:

A. Non-profits

B. Federal Governments

C. Small and local Governments

D. Both A and C

Correct Answer: D

QUESTION 4

A way to transfer risks is by joining a pool. Pools like those offered by leagues of municipalities and associations of

country commissioners provide an array of services, including:

A. Safety environment

B. Contract review

C. Claims and underwriting services

D. All of these

Correct Answer: D

QUESTION 5

One way in which federal and state governments influence local governments is by:

A. providing block grants.

B. issuing ordinances.

C. authorizing debt.

D. setting budget authority.

Correct Answer: A

Test Prep Certifications CPA-REGULATION Practice Questions 1-5

QUESTION 1

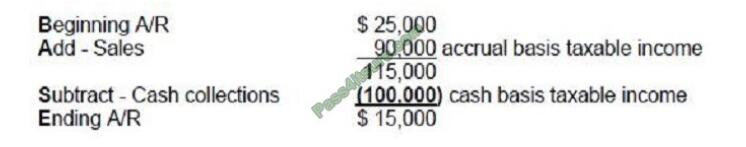

Mosh, a sole proprietor, uses the cash basis of accounting. At the beginning of the current year, accounts receivable

were $25,000. During the year, Mosh collected $100,000 from customers. At the end of the year, accounts receivable

were $15,000. What was Mosh\\’s gross taxable income for the current year?

A. $75,000

B. $90,000

C. $100,000

D. $110,000

Correct Answer: C

Choice “c” is correct. The facts state that cash collections from customers were $100,000 and as a cash basis taxpayer

this is the amount of Mosh\\’s gross taxable income for the year. Note that according to the formula BASE – we can

determine the amount of sales = $90,000, but that would give us accrual, not cash basis, income.

Choice “a” is incorrect. See above.

Choice “b” is incorrect. $90,000 is the amount of sales that would be Mosh\\’s taxable income if Mosh were an accrual

basis taxpayer.

Choice “d” is incorrect. See above.

QUESTION 2

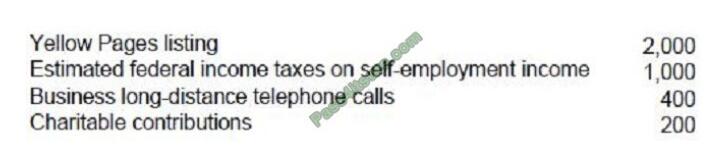

Rich is a cash basis self-employed air-conditioning repairman with 1993 gross business receipts of $20,000. Rich\\’s

cash disbursements were as follows:

What amount should Rich report as net self-employment income?

A. $15,100

B. $14,900

C. $14,100

D. $13,900

Correct Answer: A

Choice “a” is correct. Deductions to arrive at net self-employed income include all necessary and ordinary expenses

connected with the business. Estimated federal income tax payments are not an expense. Charitable contributions by

an individual are only deductible as an itemized deduction on Schedule A. This assumes the contribution was not made

with the “expectation of commensurate financial return.”

Choice “b” is incorrect. Charitable contributions are an itemized deduction unless there is an expectation of

commensurate financial return.

Choice “c” is incorrect. Federal income taxes paid are not a deductible expense.

Choice “d” is incorrect. Charitable contributions are an itemized deduction unless there is an expectation of

commensurate financial return. Federal income taxes paid are not a deductible expense.

QUESTION 3

Tom and Joan Moore, both CPAs, filed a joint 1994 federal income tax return showing $70,000 in taxable income.

During 1994, Tom\\’s daughter Laura, age 16, resided with Tom. Laura had no income of her own and was Tom\\’s

dependent.

Determine the amount of income or loss, if any that should be included on page one of the Moores\\’ 1994 Form 1040.

In 1994, Joan received $1,300 in unemployment compensation benefits. Her employer made a $100 contribution to the

unemployment insurance fund on her behalf.

A. $0

B. $500

C. $900

D. $1,000

E. $1,250

F. $1,300

G. $1,500

H. $2,000

I. $2,500

J. $3,000

K. $10,000

L. $25,000

M. $50,000

N. $55,000

O. $75,000

Correct Answer: F

“F” is correct. $1,300. Unemployment compensation benefits are fully taxable (when received by the employee), but

contributions made by the employer to the insurance fund are not taxable.

QUESTION 4

On December 1, 1997, Krest, a self-employed cash basis taxpayer, borrowed $200,000 to use in her business. The loan

was to be repaid on November 30, 1998. Krest paid the entire interest amount of $24,000 on December 1, 1997. What

amount of interest was deductible on Krest\\’s 1997 income tax return?

A. $0

B. $2,000

C. $22,000

D. $24,000

Correct Answer: B

Choice “b” is correct. Cash basis taxpayers deduct interest in the year paid or the year to which the interest relates,

whichever is later. Even though all of the interest on this loan was paid on December 1, 1997, only the interest relating

to

December 1997 can be deducted in 1997. The question does not give an interest rate, but because the loan is to be

repaid in a lump sum at maturity, 1/12 of the interest, or $2,000 applies to each month.

Choice “a” is incorrect. Because $2,000 of the interest relates to 1997, this amount is deductible in 1997.

Choice “c” is incorrect. This is the amount that cannot be deducted until 1998, the year to which the interest relates. Be

sure to read questions like this very carefully, because if you had simply misread the question as seeking the amount

deductible in 1998, you would get the question wrong despite understanding the rule.

Choice “d” is incorrect. Cash basis taxpayers can deduct interest in the year paid or the year to which the interest

relates, whichever is later, thus 11 months of the interest will not be deductible until 1998.

QUESTION 5

Wallace purchased 500 shares of Kingpin, Inc. 15 years ago for $25,000. Wallace has worked as an owner/employee

and owned 40% of the company throughout this time. This year, Kingpin, which is not an S corporation, redeemed

100% of Wallace\\’s stock for $200,000. What is the treatment and amount of income or gain that Wallace should

report?

A. $0

B. $175,000 long-term capital gain.

C. $175,000 ordinary income.

D. $200,000 long-term capital gain.

Correct Answer: B

Choice “b” is correct. An investment in a capital asset (e.g., stock) results in the income being capital (either a capital

loss or a capital gain). Ownership percentage is not a factor in the calculation, and, in this question, nor is the fact that

the

corporation is not an S corporation. The calculation is simple:

Wallace invested $25,000 in the stock and received $200,000 for 100% of his investment 15 years later.

The capital gain is $175,000 ($200,000 – $25,000), and it is considered long-term because the stock was held for

greater than one year. Choice “a” is incorrect. There is $175,000 of gain on the transaction ($200,000 – $25,000). This

type of

transaction is not a transaction that is excluded from tax in the tax code. Choice “c” is incorrect. An investment in a

capital asset (e.g., stock) results in the income being capital (either a capital loss or a capital gain). Although the

calculation of

the income is correct (i.e., $175,000), ordinary income is not the proper treatment for this transaction.

Choice “d” is incorrect. Although this transaction does result in a long-term capital gain, Wallace has basis in the stock

($25,000), and the gain is calculated as the proceeds from the sale ($200,000) less the basis in the stock.

Test Prep Certifications FINANCIAL-ACCOUNTING-AND-REPORTING Practice Questions 1-5

QUESTION 1

On January 2, 1993, Quo, Inc. hired Reed to be its controller. During the year, Reed, working closely with Quo\\’s

president and outside accountants, made changes in accounting policies, corrected several errors dating from 1992 and

before,

and instituted new accounting policies.

Quo\\’s 1993 financial statements will be presented in comparative form with its 1992 financial statements.

This question represents one of Quo\\’s transactions. List B represents the general accounting treatment required for

these transactions. These treatments are:

Correct Answer: B

Choice “B” is correct. Changes in accounting principle are handled “retrospectively.” Beginning retained earnings of the

earliest year presented is adjusted for the cumulative effect of the change and all prior year financial statements are

restated.

QUESTION 2

On January 2, 1993, Quo, Inc. hired Reed to be its controller. During the year, Reed, working closely with Quo\\’s

president and outside accountants, made changes in accounting policies, corrected several errors dating from 1992 and

before,

and instituted new accounting policies.

Quo\\’s 1993 financial statements will be presented in comparative form with its 1992 financial statements.

This question represents one of Quo\\’s transactions. List B represents the general accounting treatment required for

these transactions. These treatments are:

Correct Answer: B

Choice “B” is correct. A change in accounting principle should be shown in the retained earnings statement of the

earliest year presented as an adjustment of the beginning balance. All prior year financial statements are recast.

QUESTION 3

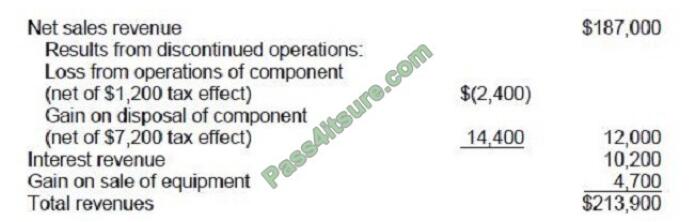

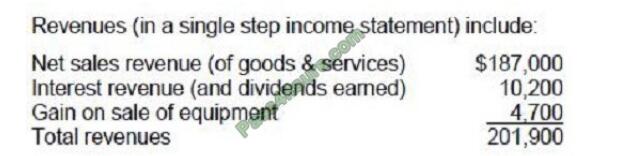

In Baer Food Co.\\’s 1990 single-step income statement, the section titled “Revenues” consisted of the following:

In the revenues section of its 1990 income statement, Baer Food should have reported total revenues of:

A. $216,300

B. $215,400

C. $203,700

D. $201,900

Correct Answer: D

Choice “d” is correct. $201,900.

The various amounts from discontinued operations should be included in discontinued operations, not in revenues.

QUESTION 4

Mellow Co. depreciated a $12,000 asset over five years, using the straight-line method with no salvage value. At the

beginning of the fifth year, it was determined that the asset will last another four years. What amount should Mellow

report as depreciation expense for year 5?

A. $600

B. $900

C. $1,500

D. $2,400

Correct Answer: A

Choice “a” is correct. Over the first 4 years, the asset would be depreciated down to $2,400. Once it was determined

that the asset would last for another 4 years, $600 would be depreciated each year of that 4 year period. This change is

a

change in accounting estimate (the estimate being the life of the asset).

Changes is accounting estimate are accounted for in the current year and future years if the change affects both.

Choice “b” is incorrect. This answer is the annual difference between the depreciation expense IF depreciation expense

had been retroactively restated ($24,000 / 8 = $1,500) and the correct depreciation expense. Retroactive restatement is

not appropriate for changes in accounting estimate.

Choice “c” is incorrect. This answer is the depreciation expense IF depreciation had been retroactively restated

($24,000 / 8 = $1,500). Retroactive restatement is not appropriate for changes in accounting estimate. Choice “d” is

incorrect.

This answer is the undepreciated amount at the beginning of the fifth year or the amount of the annual depreciation

expense for each of the first 4 years. Either way, it certainly is not going to be the depreciation expense for that year

because

the remaining cost will depreciated over the remaining period.

QUESTION 5

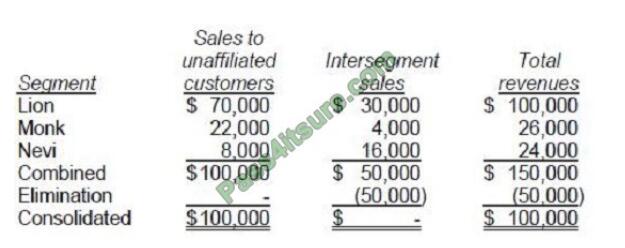

Terra Co.\\’s total revenues from its three operating segments were as follows:

Which operating segment(s) is (are) deemed to be reportable segments?

A. None.

B. Lion only.

C. Lion and Monk only.

D. Lion, Monk, and Nevi.

Correct Answer: D

Pass4itsure discount code 2020

Pass4itsure takes into account the importance of the Test Prep certification exam, we reduced the dump price of Test Prep to a discount of 12%. The discount has been applied to the AUDITING-AND-ATTESTATION, BUSINESS-ENVIRONMENT-AND-CONCEPTS, CGFM, CPA-REGULATION, FINANCIAL-ACCOUNTING-AND-REPORTING examination products to bring maximum convenience and help to customers.

Test Prep Other Exams

| AACD: American Academy of Cosmetic Dentistry | Pass4itsure AACD Dumps 149 Q&As Updated: Jul 02, 2020 |

| ACLS: Advanced Cardiac Life Support | Pass4itsure ACLS Dumps 354 Q&As Updated: Jul 02, 2020 |

| AUDITING-AND-ATTESTATION : Certified Public Accountant (Auditing and Attestation) | Pass4itsure AUDITING-AND-ATTESTATION Dumps 1025 Q&As Updated: Jul 02, 2020 |

| BUSINESS-ENVIRONMENT-AND-CONCEPTS: Certified Public Accountant (Business Environment & Concept) | Pass4itsure BUSINESS-ENVIRONMENT-AND-CONCEPTS Dumps 530 Q&As Updated: Jun 26, 2020 |

| CGFM: Certified Government Financial Manager | Pass4itsure CGFM :Certified Government Financial Manager Dumps 203 Q&As Updated: Jul 02, 2020 |

| CPA-REGULATION: CPA Regulation | Pass4itsure CPA-REGULATION Dumps 69 Q&As Updated: Jul 02, 2020 |

| FINANCIAL-ACCOUNTING-AND-REPORTING: Certified Public Accountant (Financial Accounting & Reporting) | Pass4itsure FINANCIAL-ACCOUNTING-AND-REPORTING Dumps 163 Q&As Updated: Jul 02, 2020 |

| HESI-A2: Health Education Systems Inc | Pass4itsure HESI-A2 Dumps 620 Q&As Updated: Jul 02, 2020 |

| LSAT3-ANALYTICAL-REASONING: LSAT Section 3: Analytical Reasoning | Pass4itsure LSAT3-ANALYTICAL-REASONING Dumps 60 Q&As Updated: Jul 02, 2020 |

| MACE: Medication Aide Certification Examination | Pass4itsure MACE Dumps 311 Q&As Updated: Jun 26, 2020 |

| MCQS: Multiple-choice questions for general practitioner (GP) Doctor | Pass4itsure MCQS Dumps 249 Q&As Updated: Jul 04, 2020 |

| NCE: National Counselor Examination | Pass4itsure NCE Dumps 100 Q&As Updated: Jul 02, 2020 |

| NCIDQ: National Council for Interior Design Qualification | Pass4itsure NCIDQ Dumps 45 Q&As Updated: Jul 02, 2020 |

There are two main resources for preparing for the Test Prep certification exam, first is the study guide and details, then Test Prep pdf dumps and Test Prep exam practice questions – https://www.pass4itsure.com/test-prep.html AUDITING-AND-ATTESTATION dumps | BUSINESS-ENVIRONMENT-AND-CONCEPTS dumps |CGFM dumps| CPA-REGULATION dumps| FINANCIAL-ACCOUNTING-AND-REPORTING dumps | Test Prep certification dumps |Test Prep certification pdf dumps